The Nifty 50 index closed at 24,967.75 on Monday, gaining 97.65 points (+0.39%). The market witnessed moderate buying interest in banking, auto, and energy counters, helping the index recover from early losses. Despite this uptick, the index faced resistance near the psychological 25,000 mark, which remains a crucial short-term barrier.

Global & Domestic Cues

Asian markets traded mixed this morning as investors weighed the U.S. Federal Reserve’s policy outlook and crude oil price volatility. Domestically, foreign institutional investors (FIIs) have shown cautious inflows, while strong GST collections and resilience in IT stocks continue to support sentiment.

Key Factors Driving Today’s Trend

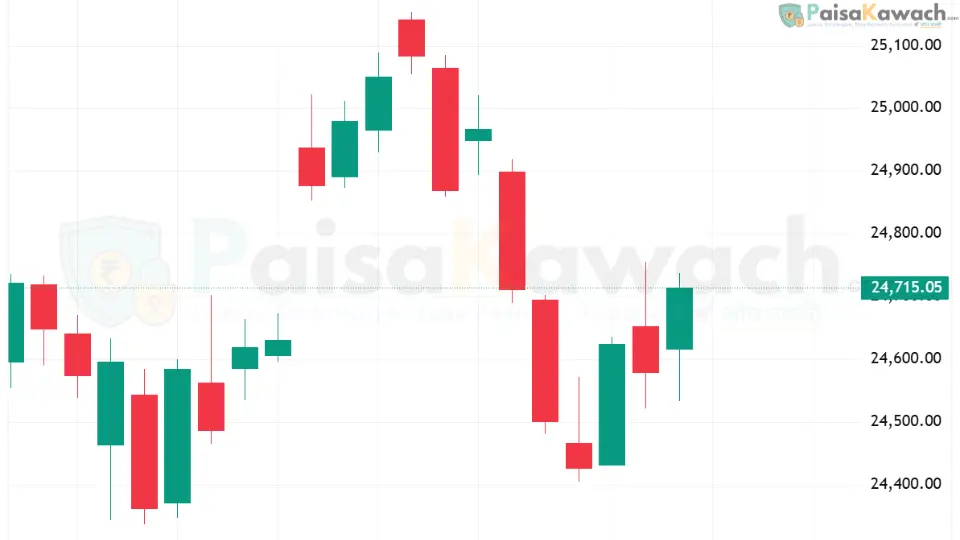

- Resistance Zone: 25,050–25,100 remains a key ceiling; a breakout may trigger fresh momentum.

- Support Levels: Immediate support rests near 24,850, followed by 24,700.

- Sector Focus: Banking, IT, and FMCG are likely to dictate near-term market moves.

- Volatility Trigger: Movement in global bond yields and foreign fund activity could swing intraday momentum.

Nifty 50 Forecast for August 26, 2025

Based on the recent candlestick formation, the index shows signs of consolidation after retesting the 25,000 mark. If Nifty sustains above 24,950, it could attempt a move towards 25,200 in the short term. However, a failure to hold this zone may bring selling pressure back toward 24,700.

Trading Strategy for Investors

- Long positions can be considered above 25,000 with strict stop-loss at 24,850.

- Short-term traders should book profits near 25,150–25,200 levels.

- Stay cautious on mid-cap stocks as volatility may rise ahead of monthly F&O expiry.

Conclusion

The Nifty 50 is at a critical juncture. While the index is showing resilience, sustained buying above the 25,000 mark is essential for a clear upward breakout. Investors should remain selective, focusing on quality large-cap names, while traders must adhere to disciplined stop-loss levels in this consolidation phase.